OAR Resources (ASX:OAR) has acquired two Exclusive Prospecting Licenses (EPL) in Namibia’s world-class uranium mining region of Erongo and concurrently applied for pegging applications for exploration packages in Brazil, as Namibia ranks as the third largest producer of uranium, contributing around 11% of the global supply.

Figure 1: OAR personnel at EPL 9725

Acquisition details

The EPL applications, submitted in September 2023, are anticipated to be approved by the second quarter of 2024.

These two EPLs, fully acquired, are strategically positioned near Walvis Bay, Namibia’s largest international port, offering easy access to well-developed infrastructure, comprehensive services, and abundant resources.

Notably, besides their proximity to substantial uranium deposits, these EPLs also exhibit high potential for Alkasite uranium mineralisation and Calcrete-Gypcrete hosted mineralisation.

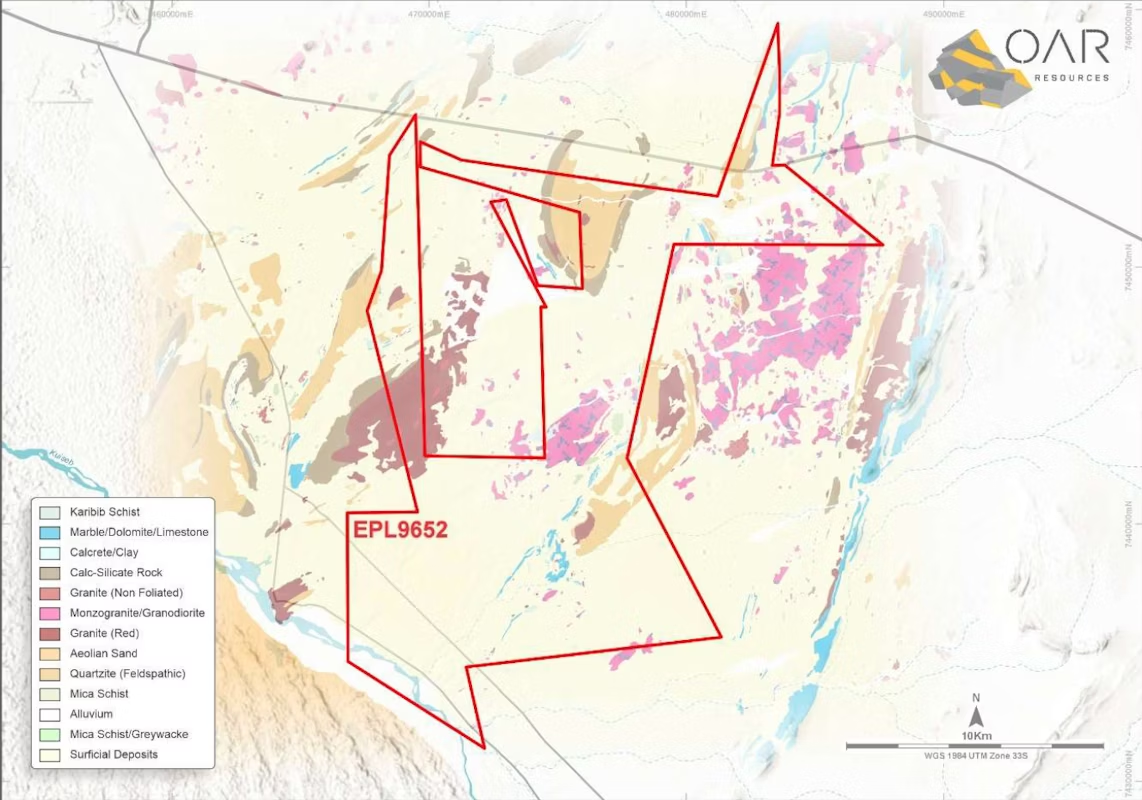

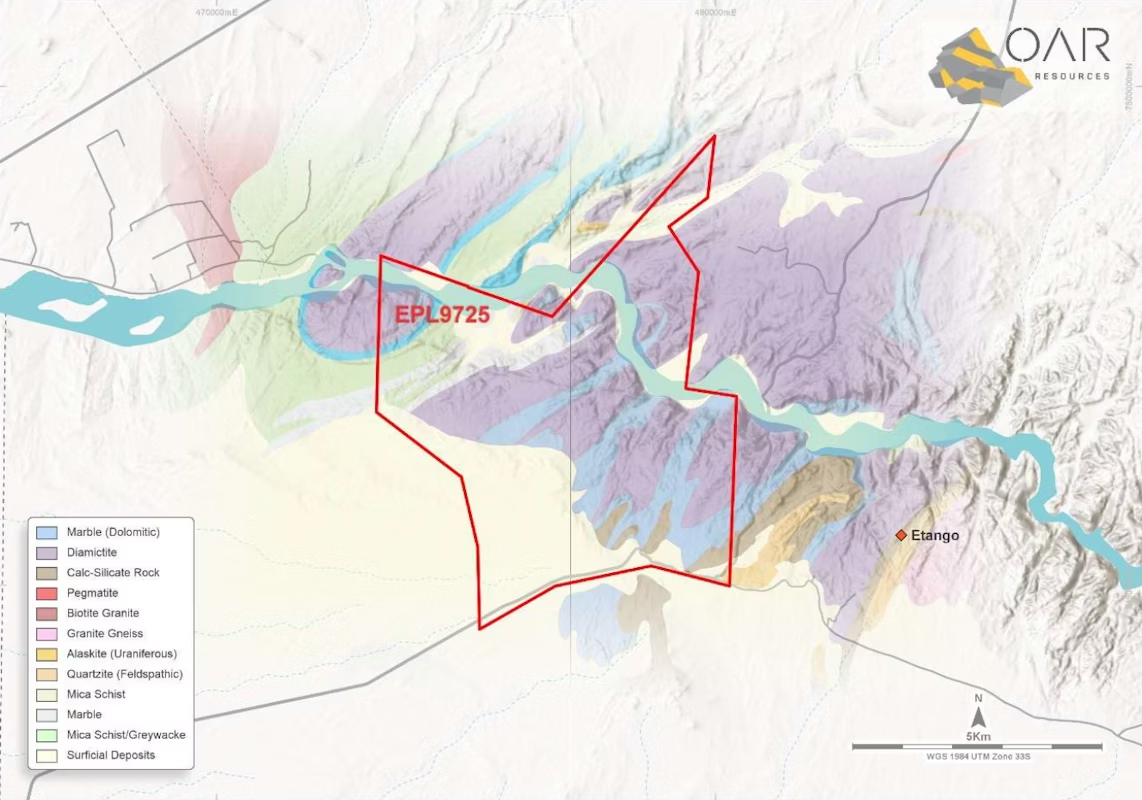

EPL 9725, spanning approximately 38.62km², adjoins Bannerman Energy’s (ASX:BMN) Etango Project, boasting a Mineral Resource Estimate of 207 million pounds of uranium. In contrast, EPL 9652 covers an extensive 189.69km² area, bordering Deep Yellow’s (ASX:DYL) Tumas Project, which holds a substantial Mineral Resource Estimate of 108.5 million pounds at 265 parts per million (ppm) uranium.

Figure 2: Map of uranium acquisition EPL 9652

OAR is currently conducting due diligence to evaluate the feasibility and suitability of the EPLs, with plans to obtain access rights and conduct non-ground-disturbing exploration activities.

Upon receiving written confirmation of the EPLs, OAR will issue 50 million ordinary shares for each license. Additionally, if the company announces a compliant uranium resource of 50 million pounds at 100 ppm or higher on each EPL within four years of acquisition, a further 50 million ordinary shares will be issued to the vendors.

Vendors will receive a 2% net smelter royalty for all minerals extracted by OAR, with the explorer retaining a first right of refusal over the royalty for three years following the issue date. Upon approval of the EPLs, the tenements will undergo environmental studies to obtain an Environmental Clearance Certificate.

Subsequently, OAR will lodge an Environmental Impact Assessment (EIA) with the Namibian Ministry of Mines and Energy, streamlining fieldwork on the EPLs and facilitating planning for its drill program.

Figure 3: Map of uranium acquisition EPL 9725.

Namibian outlook

OAR Resources Chief Executive Paul Stephan expressed confidence that the proximity of globally renowned deposits has enhanced OAR’s expectations for the exploration areas, anticipating similar exploration styles.

“The acquisition in Namibia is significant, with both EPLs located close to a well-known uranium-enriched structural corridor and considered prospective for multiple styles of uranium mineralisation,” he said.

“Encouragingly, both tenements share boundaries with the highly prospective Deep Yellow Limited’s Tumas Project and world-class Bannerman Energy Ltd’s Etango Project, located along strike from the Husab, Rossing, Valencia and Norasa deposits.”

Brazilian Tenements

In a parallel initiative, OAR has filed pegging applications for two exploration packages targeting potential uranium and ionic clay hosting Rare Earth Elements (REE).

These applications aim to secure exploration tenements for Brazilian projects, including the Sao Jose Uranium and REE Project in northern Paraiba, and the Tunas REE Project in Parana, spanning a total area of 230km2.

OAR has formed an on-site exploration team for the Sao Jose Project, poised to shift to analogous tasks at the Tunas Project post initial geological mapping, with the expectation that these endeavours will augment its status as a diversified global resource company, prompting a keen interest in procuring further high-caliber projects in Brazil.

Figure 4: Location of OAR’s recently pegged Brazilian Projects

Company commentary

Mr. Stephan emphasised that the acquisition of projects in Namibia and Brazil is a strategic move aimed at diversifying the company’s exploration portfolio.

Figure 5: Map of OAR’s recently acquired projects in Namibia and Brazil

“We are strategically diversifying our portfolio as part of the Company’s exploration strategy, with these tenements marking a great opportunity to develop uranium-focused exploration in tier one destinations,” he said.

“The Company has also leveraged its vast experience and resources to secure an extensive package of mining rights in Brazil, where we’re witnessing a significant change in policies around uranium mining and exploration.

“Strategically expanding our portfolio is our priority, and the Company has worked diligently over the last quarter to find the right projects with strong resource and growth opportunities,” he added.

OAR’s Australian Security Exchange-listed share price is currently trading at $0.002 (10:30 am UTC+ 8 hours).